You Don’t Need More Hustle. You Need a Clear Plan That Works.

Grab the free starter pack that shows you exactly where you stand and what’s possible from here.

You don’t need to work harder — you need a plan that actually works.

This free starter pack flips the switch:

💥 The Money Planner shows what it really costs to live so you can stop stressing, start breathing, and finally take control.

⚡ The Ideal Week Calculator shows how little time you actually need to start something of your own even just weekends.

You’ve got bills, dreams, and a life to build.

This is your first step toward freedom on your terms.

My Money Planner My Money Planner

Get Clear On Where You’re At

Track your income, bills, spending, and savings in one place.

See if you’re behind, breaking even, or ahead and what to do next.

Ideal Week Calculator Money Planner

See What’s Possible With Your Time

Design your dream week based on your goals, lifestyle, and availability. Perfect if you’re planning a business, side hustle, or want more balance.

What you’ll gain

-

✅ A Full Picture of Your Finances

Know exactly what it costs to live, save, and grow all in one place. -

🧠 Mental Clarity and Confidence

Stop guessing and start making real decisions with your time and money. -

📅 A Schedule That Works for You

Design your ideal week based on real-life goals, availability, and priorities. -

⚡ Proof You Don’t Need More Time Just a Plan

See how even a few hours a week can move you toward freedom. -

🛑 The Power to Stop Stressing About Money

Get clear, get calm, and take control of your next step. -

🚀 The Green Light to Start Something of Your Own

Whether it’s a business, side hustle, or more balanced life the path begins here.

What’s inside

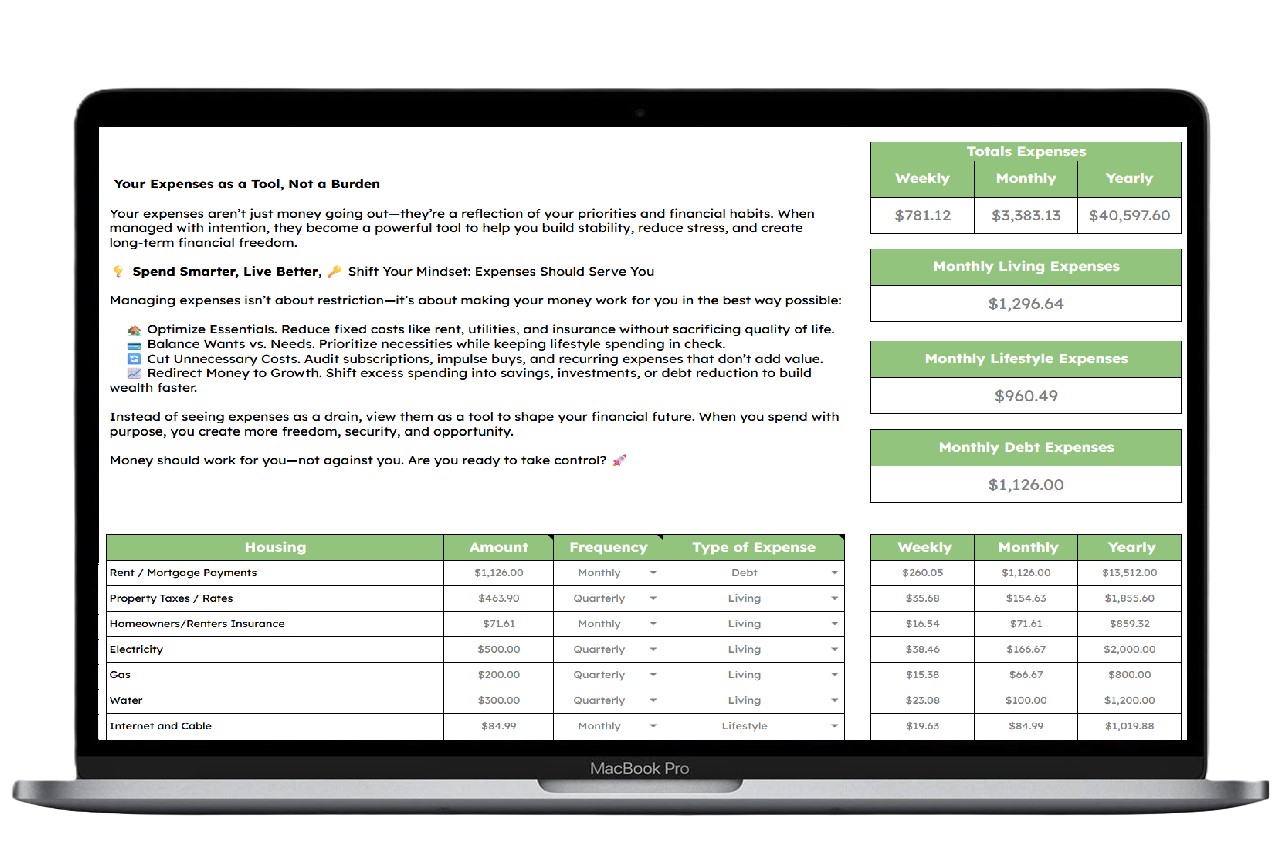

Track Your Real Expenses

Get brutally honest about your financial reality. This page shows exactly what you’re spending, where your money’s going, and what it actually takes to survive without fluff or guesswork.

Instant Results Snapshot

See your full money picture in one hit income, expenses, surplus or shortfall. Whether you're behind, breaking even, or ahead, this page tells you what’s working and what needs fixing.

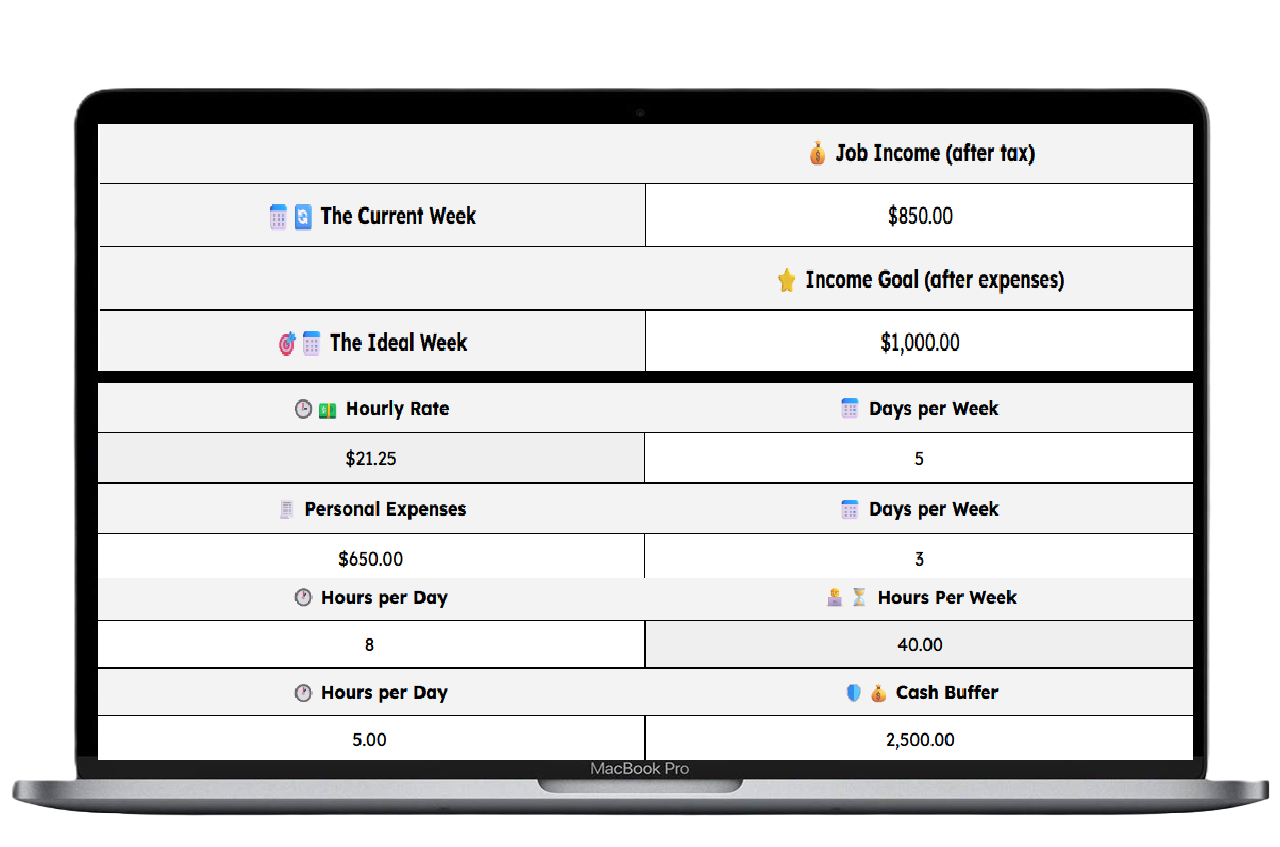

Your Weekly Income Summary

This is where it clicks. See how much you can earn based on your available time whether you offer a service, sell a product, or build a membership. It’s the proof that part-time can still move the needle.

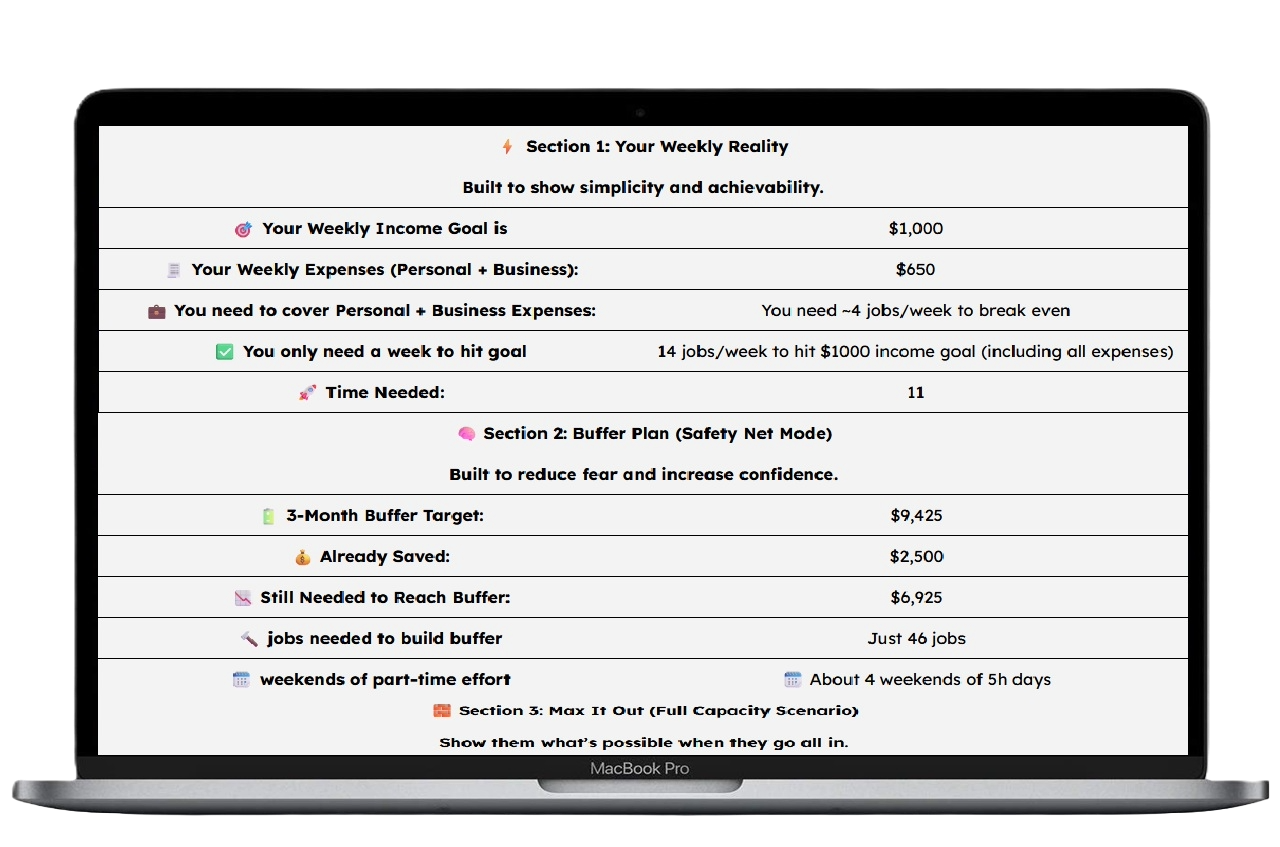

Design Your Week, Your Way

Plan your week based on your life not someone else’s schedule. Use this to map your availability, priorities, and non-negotiables so you can build income around your real life.

🚀 Be First in Line for What’s Coming

✔️ Done-for-You Business Toolkit

Templates, tools, and guides to help you start or grow a business the smart way built from real-world experience.

✔️ Monthly Mastery Circle

Ongoing support, fresh resources, planning sessions, and Q&As designed to keep you moving, not just motivated.

✔️ Early-Bird Access & Bonuses

Join the wait list to unlock first access, special pricing, and early-bird perks you won’t get later.

Coming Late 2025 join the wait list and get notified first.